Americans owe 1.5 trillion dollars in student debt. It may be difficult to comprehend, but on average, each borrower owes between twenty to twenty-five thousand dollars. However, this debt is not evenly distributed. Over six hundred thousand people carry a burden of two hundred thousand dollars or more. Surprisingly, even individuals over the age of sixty have accumulated eighty-five billion dollars in student debt. Some of this debt can be attributed to older generations supporting their children or grandchildren through school. In fact, the total amount of student debt surpasses all outstanding credit card debt in the country. Many individuals are hoping for someone to take action on this issue. Given that the federal government holds about 90 percent of outstanding student debt, there is a stronger case for them to intervene compared to situations like car loans or mortgages. Nevertheless, there are concerns about who would ultimately benefit from the erasure of student debt. Currently, student loans are mostly held by relatively affluent families. This raises the question of whether it is a good idea to erase student debt. To understand the origins of this problem, we need to go back to the turn of the century. While student debt has existed for a while, it significantly increased during this time. Additionally, the government's involvement in student debt is a more recent phenomenon. As part of Obamacare, the government stopped insuring private bank loans and took on a larger role in lending directly. This was intended to save money and offset the costs of Obamacare. During the recession, when the Federal Reserve kept interest rates low, students could borrow at more favorable rates. However, by 2013, there were growing demands to lower interest rates. Currently, big banks can access loans through the Federal Reserve discount window at a rate of about three-quarters...

Award-winning PDF software

Student loan forgiveness programs Form: What You Should Know

Do not apply for any other Perkins Loans or Federal Family Education Loan (FEEL) Program loans in order to be eligible for the PSL program. The PSL Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working and Public Service Loan Forgiveness (PSL) The PSL Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working Public Service Loan Forgiveness (PSL) & Temporary To qualify for forgiveness, I must be employed full-time by a qualifying employer when I apply for and get forgiveness. Complete and submit Public Service Loan Forgiveness (Public Service Loan Forgiveness) (PSL FA) Application Form when using the PSL FA to confirm eligibility and complete your Public Service Loan Forgiveness. Do not apply for any other Perkins Loans or Federal Family Education Loan (FEEL) Program loans in order to be eligible for the PSL program. If you're still not sure whether to apply for the Public Service Loan Forgiveness program, see if you meet the requirements for Public Service Loan Forgiveness. If you are a dependent student working full-time and making a minimum monthly payment of 240 on your Direct Loans, the amount of Direct PLUS Loans you can borrow under the PSL program is reduced by 240. You qualify for the PSL Program if you are under the age of 30 at the time your Direct Loans are forgiven, or you have met all the following requirements: Direct Subsidized Loan Borrower must earn at least a 2.5 GPA; no student can have a parent on file for FSA loans Borrower must have earned at least a 2.5 GPA in undergraduate college; no student can have a parent on file for FSA loans Direct Unsubsidized Loan Borrower must earn at least a 2.5 GPA in undergraduate college; no student can have a parent on file for FSA loans Student's Income (based on Family Size) Must have annual gross income under 75,000 (this income limit varies for other federal student loans) for students whose families earn less than 75,000 Direct PLUS Loan Borrowers must have at least a 2.

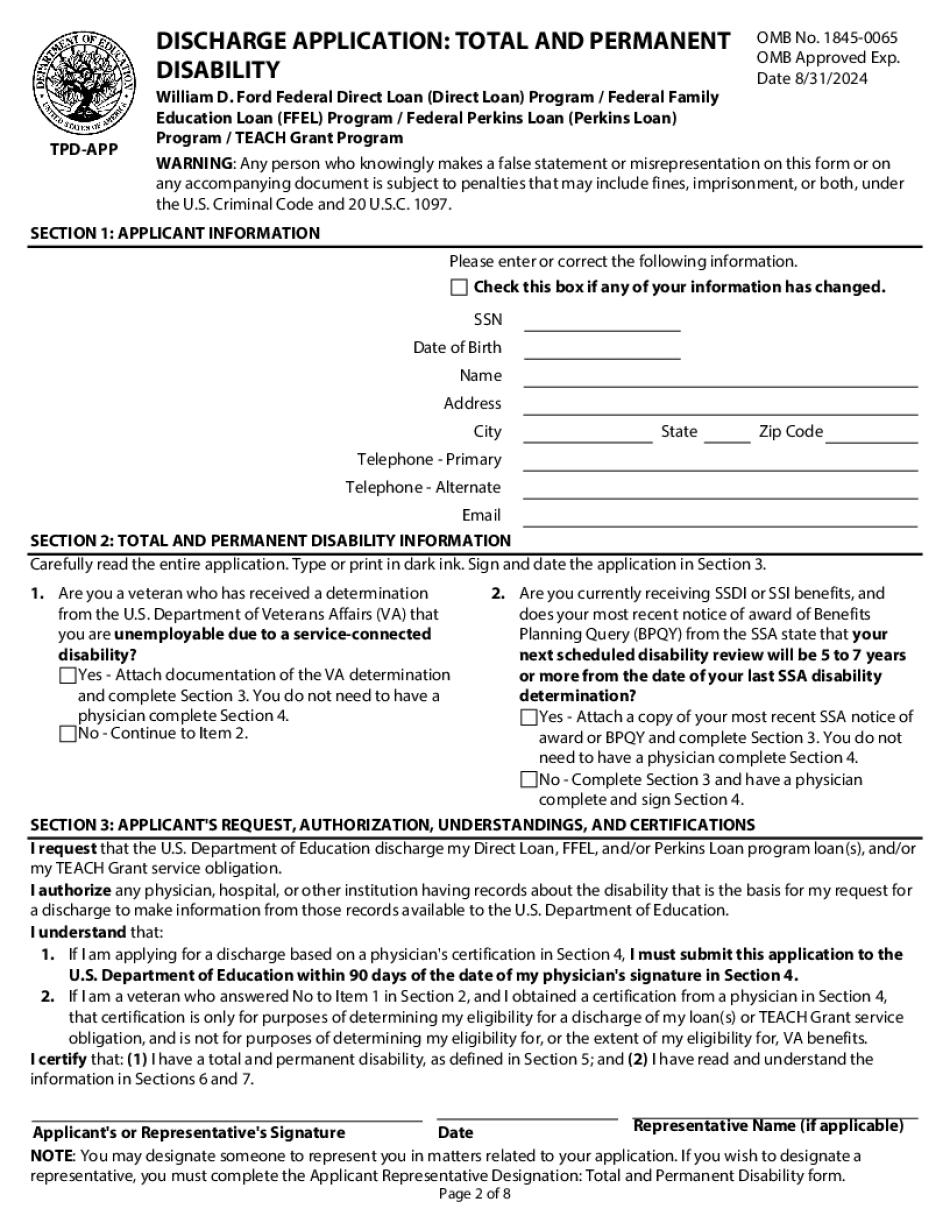

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Discharge Application, steer clear of blunders along with furnish it in a timely manner:

How to complete any Discharge Application online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Discharge Application by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Discharge Application from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Student loan forgiveness programs