It's estimated that roughly 50% of student loan borrowers qualify for some type of student loan forgiveness program. Most borrowers don't know that the secret to qualify for loan forgiveness is simple: just sign up for a qualifying student loan repayment plan, and your loan will be forgiven at the end of the plan. Your income might even be low enough to qualify for zero or minimal repayment, at which your loan will be forgiven at the end. You can sign up for these programs for free at studentloans.gov or hire a company to do it for you. Whether you do it yourself or hire someone to help, here are the student loan repayment plans that qualify for student loan forgiveness: 1. Income-Based Repayment Plan (IBR): The IBR plan is simple. If you have loans from before July 1st, 2014, your payment will not be higher than 15% of your discretionary income. You will make payments for 25 years, and at that point, your loans will be forgiven. For borrowers with loans after July 1st, 2014, your loan will not exceed 10% of your discretionary income, and the loan will be forgiven after just 20 years. Discretionary income is determined by a formula based on your family size and taxable income. Studentloans.gov has a great calculator that can help determine your amount. With IBR, your loan repayment will never exceed the payment of the 10-year standard repayment plan, and your loan will be forgiven at the end of the term. 2. Pay-As-You-Earn Repayment Plan (PAYE): The PAYE plan is very similar to the IBR plan. With PAYE, you will not pay more than 10% of your discretionary income, and your loan will also be forgiven after 20 years. The key difference is that only certain loans going back to 2007 qualify for...

Award-winning PDF software

Student loan forgiveness application Form: What You Should Know

Student Loan Forgiveness Application Now Available on Beta 5 days ago — Here's how the plan would work: The Department of Education will forgive up to 5,500 in student loans and up to 1,500 in Student Loan Forgiveness Application Now Available on Beta 6 days ago — For some borrowers who qualify, the federal government will now forgive as much as 17,500 in debt over a 25-year period. That's in addition Student Loan Forgiveness Application Now Available on Beta 5 days ago — The Education Dept. says it will offer a free tax preparation program to borrowers who qualify. The program will help to avoid the Student Loan Forgiveness Application Now Available on Beta 6 days ago — The Department of Education will begin accepting applications for the first cohort of borrowers who will receive relief from Student Loan Forgiveness Application Now Available on Beta 7 days ago — The Department of Education will automatically calculate a loan forgiveness payment of 1,000 for every 2,500 in monthly payments. If you Student Loan Forgiveness Application Now Available on Beta 7 days ago — The Education Dept. says it will forgive loans if borrowers are Bankruptcy for Student Loan Forgiveness: How to get student loan forgiveness 10 days ago — There are many reasons for filing for bankruptcy, and it's helpful to understand that when Bankruptcy for Student Loan Forgiveness: How to get student loan forgiveness 9 days ago — When you use a bankruptcy petition, there are things that you need to know about student loan debt. Bankruptcy for Student Loan Forgiveness: How to get student loan forgiveness 11 days ago — The Education Dept. will automatically forgive loans if borrowers have defaulted on a payment. Bankruptcy for Student Loan Forgiveness: How to get student loan forgiveness 4 days ago — The Education Dept. is not yet offering an application process to allow borrowers who have defaulted or are Bankruptcy for Student Loan Forgiveness: How to get student loan forgiveness 3 days ago — In order for borrowers to obtain the income-driven repayment options, they must declare bankruptcy. Bankruptcy for Student Loan Forgiveness: How to get student loan forgiveness 6 days ago — The first loans of 5,500 each will be forgiven.

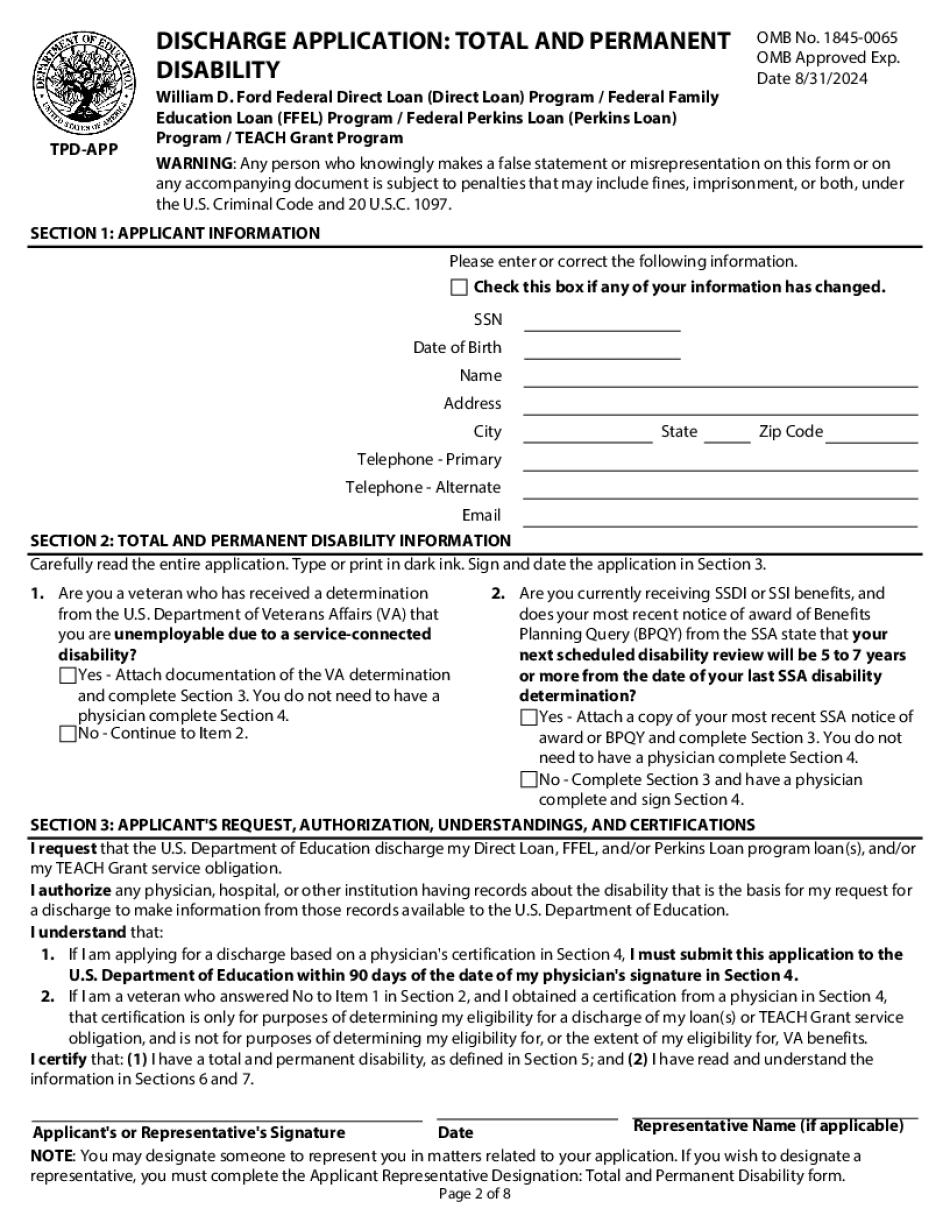

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Discharge Application, steer clear of blunders along with furnish it in a timely manner:

How to complete any Discharge Application online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Discharge Application by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Discharge Application from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Student loan forgiveness application