Today, we are going to be talking all about public service loan forgiveness and how it works. We are Tasha and Justin from One Big Happy Life, where we make videos about finding balance, building wealth, and living a happy life. If you want more videos on creating the life you want on your own terms, this is the place to be. Subscribe and hit that notification bell. Today's video is all about public service loan forgiveness, which many of you have requested because we are pursuing this program. In our net worth updates, we always mention our progress with public service loan forgiveness and the number of payments we have left. However, many people ask us about the news and if we have read the articles. Yes, there is a lot of misinformation out there, which has created a negative perception of the program. In this video, we want to clear up some of that misinformation and help you understand how the public service loan forgiveness program works. However, we will likely need to do a separate video to address common misconceptions and not overwhelm you with too much information at once. The first thing you need to understand about student loans is that they are a type of debt. A debt is created through a contract that outlines the terms, including the amount owed, interest rate, required number of payments, and sometimes the payment amount. Your master promissory note, which creates the debt for your student loans, does not list the exact loan payment because you get new loans each year while in school. However, it does discuss repayment options and how payments will be calculated when you enter the repayment phase. Now, let's discuss the two major types of student loans: private student loans and federal student...

Award-winning PDF software

Student loan forgiveness Form: What You Should Know

Registration. Affiliated Firm. Means any person that is a member of the same firm engaged in the same. U.S. federal income tax return under section 6662(e)(8) for each calendar year covered by this return. These terms are set forth in section 1(a) of the Investment Adviser's Act and Regulations. Form U4 with an Exemption Certificate — FINRA Certain forms with an exemption certificate may be filed with CRD (CTC). Exceptions — Form U4 | FINRA.org Form U4 with an Exemption Certificate — FINRA Form U4 Exemption Certificate of Exception— Form U4 | FINRA.org Form U4 with an Exemption Certificate — FINRA Form U4 Exemption Certificate of Exception (Ex) — CT.gov Form U4 Exemption Certificate of Exception — FINRA Form U4 Exemption Certificate Exempt— Form U4 | FINRA.org Form U4 Exemption Certificate Exempt— CT.gov There will be certain exceptions to filing your Form U4 with CRA where you are not required to file a Form 990. Please review the Form 990 exceptions with CRA in their site for more information. Expired and/or Suspended Accounts — Form 990 and/or Form 4059 For all Form 990 and/or Form 4059, if you have had accounts with your broker, custodian or bank or if the broker, custodian or bank terminated your account (expired or suspended), it does not matter if you subsequently opened a new account with this broker, custodian or bank, you should include one of the following Forms 990 or Form 4059: Form U4 with a Form 1099 — CRD The following instructions pertain to Form U4 with a Form 1099. Form U4 with an Exemption Certificate — FINRA Section 1001.1.13 allows the IRS to provide, in certain limited circumstances, for an exception from filing a Form U4. The IRS will consider all the facts and circumstances with a particular broker, trustee, or other intermediary to determine whether a Form U4 can be filed with this broker, trustee, or intermediary. Form U4 with a Form 1099 — CRD The following instructions pertain to Form U4 with a Form 1099 for individuals.

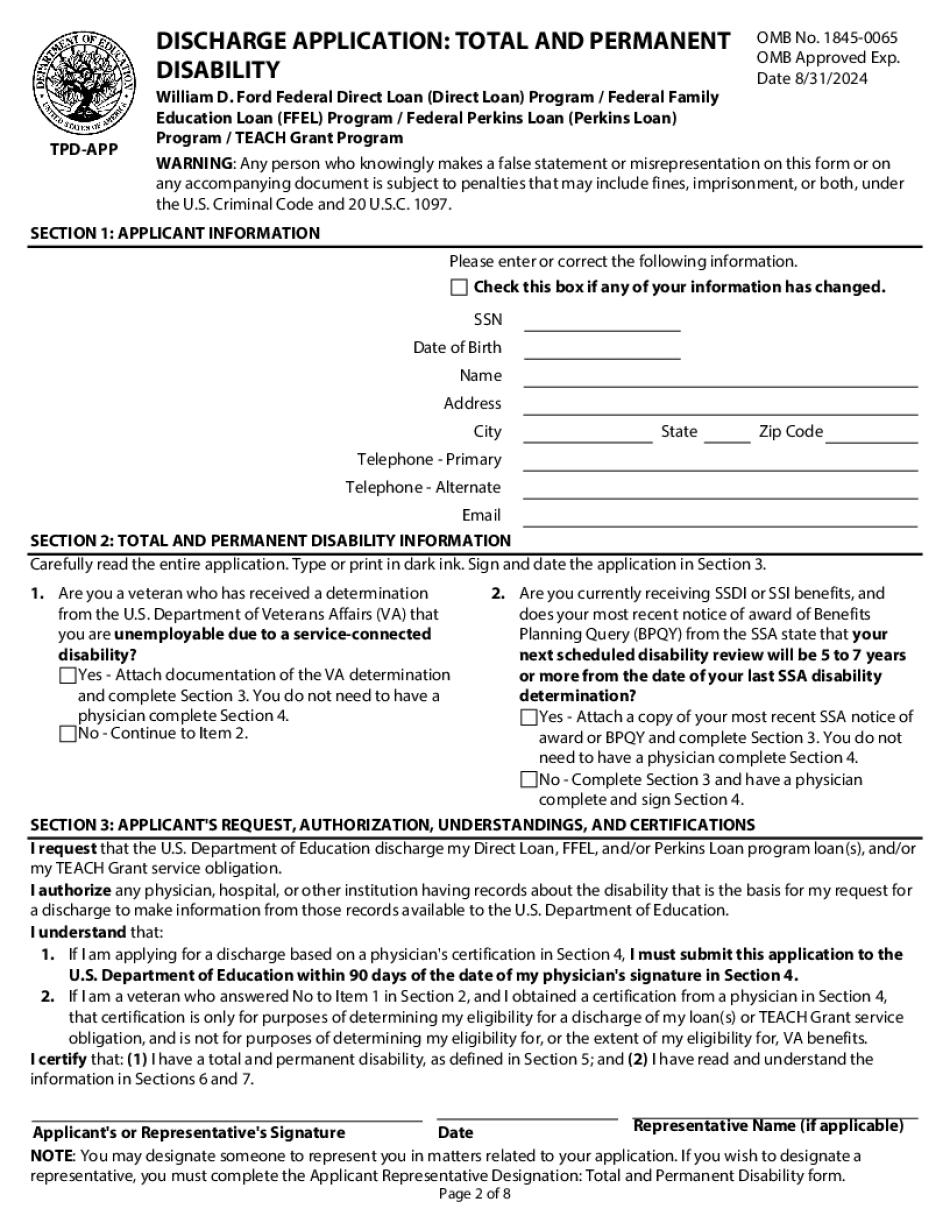

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Discharge Application, steer clear of blunders along with furnish it in a timely manner:

How to complete any Discharge Application online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Discharge Application by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Discharge Application from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Student loan forgiveness form