Hi, this is Cindy King with my daily video for today. Tim, today, I'm going to briefly discuss canceling your student loan based on false certification reasons. Now, we've been talking about reasons that you can cancel your student loan. If the school failed in making sure that a student was not qualified to attend that school, then the student may be able to cancel any loans due to what they term as false certification. The types of loans must be your Direct Loans or the FF II L type of loan. Now, the money from these loans had to have been received after January 1st of 1986. And, as we have discussed earlier, if any consolidation loan was used to pay off any of these loans, then a portion of the loan, the consolidation loan, may be able to be canceled. If you had a Perkins loan, it's best for you to contact a lawyer to help you see what your options might be. Now, let me give you a list of requirements for false certification. Number one, the student did not have is GED or high school diploma, and the student wasn't properly tested by the educational institution to make sure they'd benefit from the program. That's reason number one for false certification. Number two reason is, at the time the student enrolled, they were not able to meet licensing requirements for employment in the field. Number three, the school falsely signed the loan papers or checks, unless the money from the loans was used to pay for amounts that were owed to the school. And lastly, somebody used identity theft, which as we know is a crime, to actually get those loans under your name instead of actually if it was actually you. Now, this is giving you a...

Award-winning PDF software

Loan Discharge Application false certification Form: What You Should Know

G., grants, loans, and loans held by institutions of higher education); or For more information about loan discharge, visit Loans.gov (b) Any person who knowingly makes a false certification, certifies a credit rating, or applies false information in accordance with an agreement for Any person who knowingly makes a false certification, certifies a credit rating, or applies false information in accordance with an agreement for (d) For purposes of this section, fraud is the unlawful use of the information, or the intentional making of a false (e) A school seeking loan financial assistance from the Secretary of Education, or any related bureau, agency, or instrumentality of the United States for the purpose of [31 C.F.R. § 685.215(e)]; The Secretary's definition of “personally liable” is: a person who knowingly makes false, inaccurate, or fraudulent representations regarding any of the following: Loan Discharge Application: False Certification or Credit Loans.gov See Frequently Asked Questions 2.8 for more information about False Certification. [26 C.F.R. § 685.210(a)] [31 C.F.R. § 685.215(a)] [31 C.F.R. § 685.215(a)] 34 CFR § 685.215 — Discharge for false certification of student (2) (b) Any person who, with intent to defraud, gives false information on an Application for [31 C.F.R. § 687.7(b)(3)] or False Certification (a)(2) in order to obtain any financial assistance from the Secretary of Education under—(i) Federal student financial assistance program; (ii) programs administered by an administrative unit of a Federal, State, or local government; or (iii) Federal agency grants or contract 34 CFR § 685.

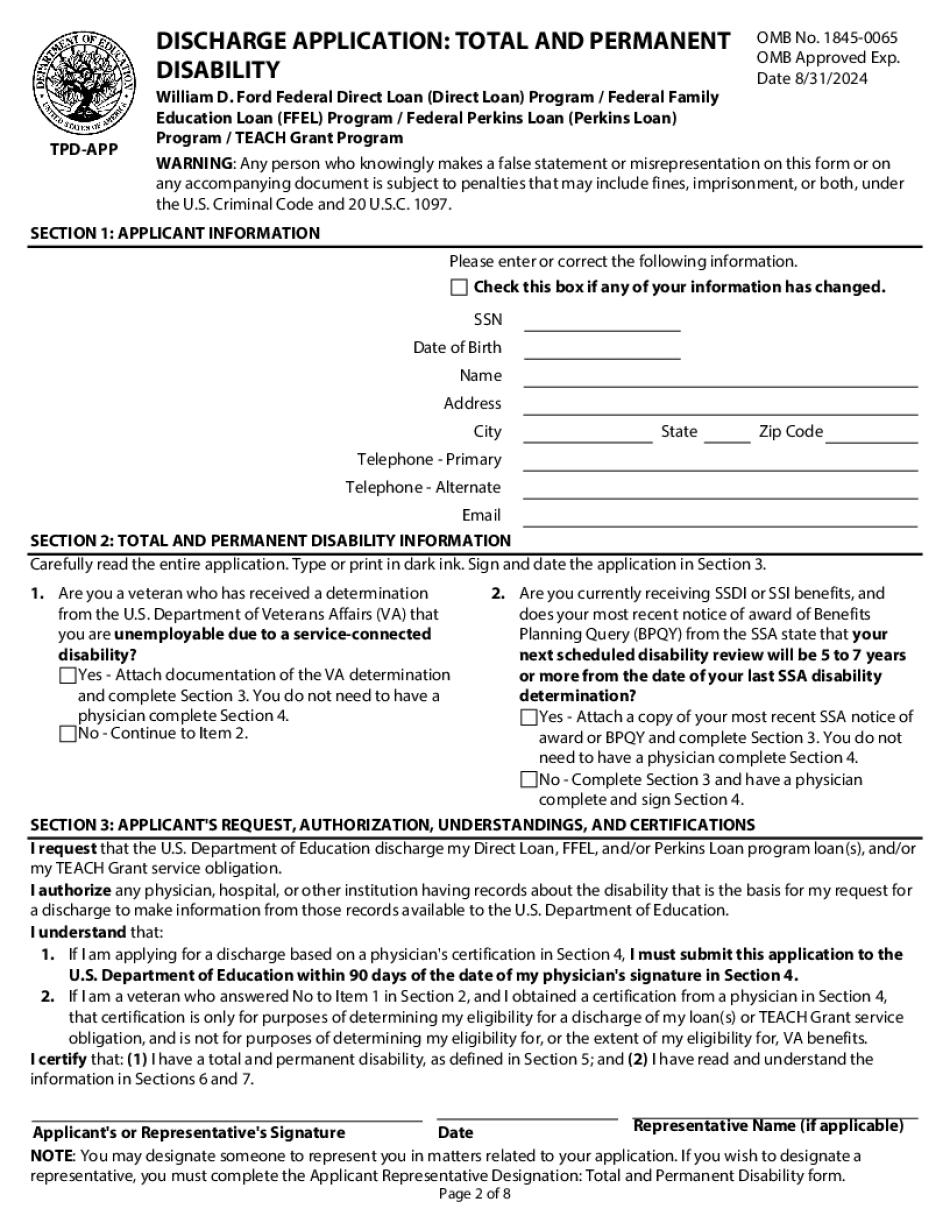

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Discharge Application, steer clear of blunders along with furnish it in a timely manner:

How to complete any Discharge Application online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Discharge Application by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Discharge Application from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Loan Discharge Application false certification