Hey, it's John McPhee, the numbers guy. I wanted to cut this video to talk about something important regarding student loans. Many people are graduating from college with a new degree, but they're also burdened with a significant amount of debt. To cope with this debt, they often utilize a program called student loan income-based repayment. Essentially, the government offers lower monthly payments while allowing the loan balance to accumulate over time. The idea is that if you still have a loan after 20-25 years, the government will forgive the remaining balance. On the surface, this program may seem beneficial, but there are a couple of pitfalls to be aware of. Now, you won't be surprised about these pitfalls since you're watching this video. Let's look at an example I shared at the wealth summit in Las Vegas in 2015. Many individuals we work with graduate with $100,000 to $200,000 in student loan debt. In this particular case, the student loan balance was $145,000, and the borrower was paying 6.8% interest on a 25-year income-based repayment plan. The monthly payments initially start low at $43.16, but they increase over time based on the borrower's income. Each year, the borrower must file their income information, and the government determines the monthly repayment amount based on their income and other factors. In this example, the monthly payment increases to $200 in year four, $500 in year 11, and $1,000 in year 18. These payments continue until the end of the 25-year period. However, this also means that the loan balance keeps growing. After 25 years, the loan balance in this example has ballooned to over $500,000. At this point, many people assume that the government will forgive this balance. However, the cost is that when the loan is forgiven, the forgiven amount is considered taxable income....

Award-winning PDF software

Student loan forgiveness for nurses Form: What You Should Know

Refill V112 online to update. Try Now! Form and guidance to declare exemption from MOT. Published 1 October 2012. Last updated 12 October 2020. + show all updates. Apply for a vehicle tax exemption — GOV.UK valid when the tax starts, or evidence if your vehicle's exempt from an MOT (V112); an insurance certificate or cover note (only in Northern Ireland). L1-declaration-of-exempt-from-mot.f — GOV.UK Your Signature: By signing this form you are confirming that the information provided is correct and the vehicle is exempt from MOT testing. CSE. L1. L1 Declaration of exemption from MOT — Fill Online, Printable, Fillable, Blank | filler Fill L1 Declaration of exemption from MOT, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with filler ✓ Instantly. Try Now! Fillable Declaration of exemption from MOT (L1) — PDF Lin Declaration of exemption from MOT (L1) ✓ easily fill out and sign forms ✓ download blank or editable online. Refill L1 online to update. Try Now! Form and guidance to declare exemption from MOT. Published 1 October 2012. Last updated 12 October 2020. + show all updates. Apply for a vehicle tax exemption — GOV.UK valid when the tax starts, or evidence if your vehicle's exempt from an MOT (V112); an insurance certificate or cover note (only in Northern Ireland). L2-declaration-of-exempt-from-mot.o — GOV.UK Your Signature: By signing this form you are confirming that the information provided is correct and the vehicle is exempt from MOT testing. CSE. L2. L2 Declaration of exemption from MOT — Fill Online, Printable, Fillable, Blank | filler Fill L2 Declaration of exemption from MOT, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with filler ✓ Instantly. Try Now! Fillable Declaration of exemption from MOT (L2) — PDF liner Declaration of exemption from MOT (L2) ✓ easily fill out and sign forms ✓ download blank or editable online. Refill L2 online to update. Try Now! Form and guidance to declare exemption from MOT. Published 1 October 2012. Last updated 12 October 2020. + show all updates.

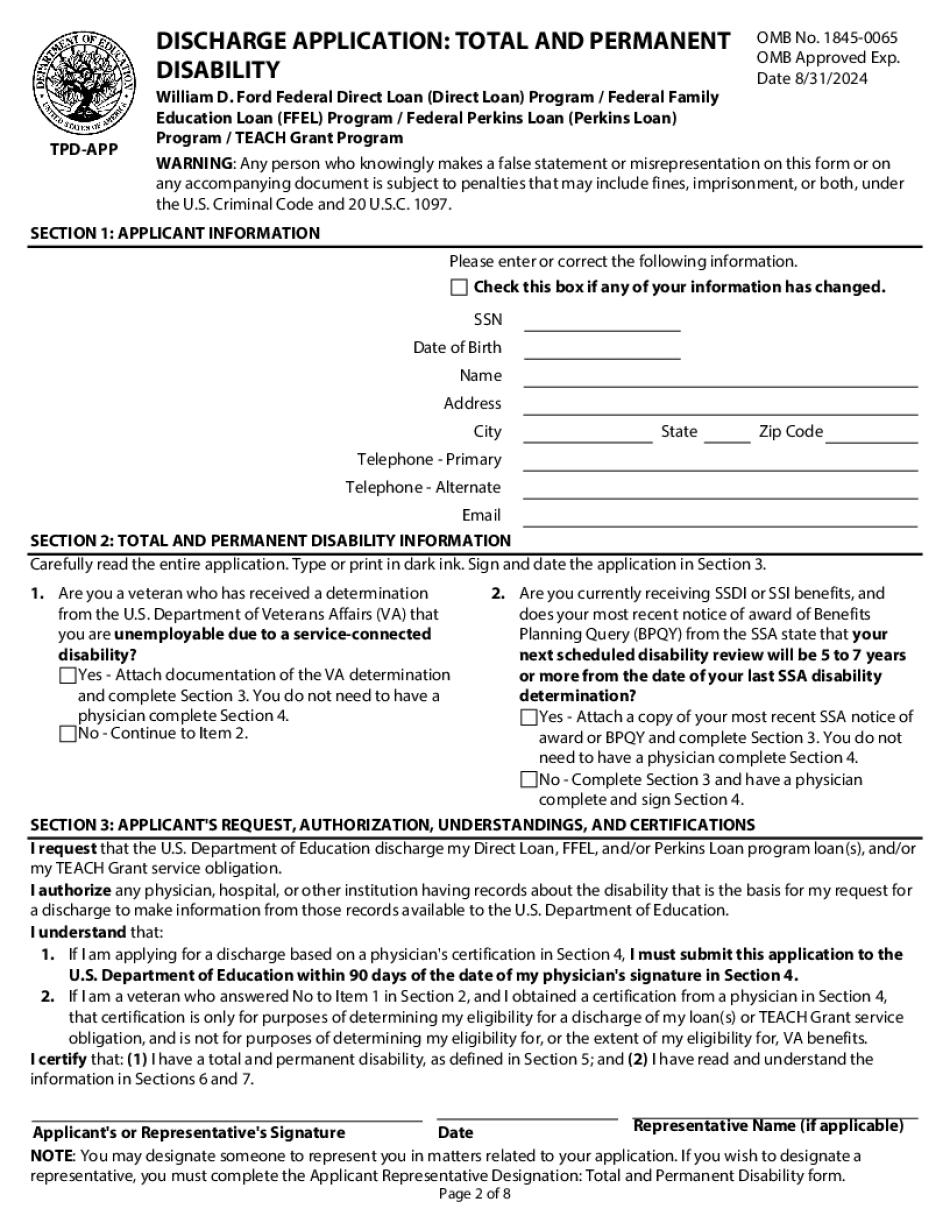

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Discharge Application, steer clear of blunders along with furnish it in a timely manner:

How to complete any Discharge Application online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Discharge Application by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Discharge Application from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Student loan forgiveness for nurses