Sara starts off this hour in New York City. Hi Sara, welcome to the Dave Ramsey show. Hi Dave, thank you so much for taking my call. Sure, what's up? I have a question about the end of the baby step two. I need help negotiating my last student loan. Sorry, I'm really excited. I'm really nervous. Just a little bit of background, I'm a regular income from the classical soprano in New York City, and I'm about to go into a dry spell over the summer, and I want to get this done by the end of June, and it feels like a huge roadblock. I've paid off $65,000, and okay kiddo, you're almost there. Okay, I can see the finish line. So you've paid off 65, how much is the student loan? How much is the student loan? $8,686, okay. I gave my first offer of a thousand, and there's a bunch of collection fees on top of it with the company who's managing it with a home office. They're in St. Louis. Is this a Sallie Mae loan? No, it's not. This is a private student loan. Sallie Mae is going to be done by May. This is my last one. Okay, and are you behind on this loan? Way, way behind. I haven't made a payment and so on, I can't even remember. Okay, so basically, you have an unsecured loan, a private loan that happened to be used for tuition, so we're calling it a student loan. And because it's not a government loan, you won't be able to negotiate the balance, so as it's got a government guarantee on it. But this is $8,600, all our principal balance, and it's been years since it's been paid on, correct? Okay, and what are they saying...

Award-winning PDF software

Private student loan forgiveness Form: What You Should Know

Interest Payee Name, Last Name, and Social Security Number. If the account is from a for-profit or not approved school, simply complete the “Forbearance Form”. If you are in default or defaulted, complete the “PSL Form”. Payments on your debt are considered on grace periods of up to 15 years. The last payment made before the grace period is considered as a qualifying monthly payment for your Public Service Loan Forgiveness, if you meet the qualifying conditions from each type: Direct Unsubsidized Subsidized Direct PLUS Unsubsidized Direct Consolidation PLUS Student Loan Consolidation If you are in default on your Direct PLUS Loans, please read this post. Note: After 10 years, all remaining balance on your loan will be forgiven (unless you qualify for forgiveness on all debt, and you are a current borrower). If a Direct Consolidation loan is used in combination with another loan, for a total of 40,000 in consolidated debt, that loan must be consolidated before the combined amount is forgiven. You can learn more about Consolidation loans on the website for the Secretary of Education. If at any time your debt is forgiven, you will be sent an email letting you know. If you are under 22 and have a Direct PLUS Loan, contact your lender immediately to report on the forgiveness of some of your existing Direct loans. If you have a Direct Subsidized Loan or a Direct Unsubsidized Loan, you may have the student loan forgiven even if you never completed all the Direct loan requirements If you have student loans from any of the services listed above, your student loan debt is considered dischargeable if your loan is found to be either unpaid upon collection; or forcible taking If you have student loans from any of the services listed above. The discharge of all or any part of your student loan debt does not relieve you of any other Federal, State, or local taxes, including penalties and interest. This means that other State and Federal taxes may be owed; and You may still need to report on your Federal taxes. If you do not wish to make a payment on your student loan, contact the service to resolve the dispute. Direct PLUS Loans are forgiven after you have made 15 years of service on federal student loans.

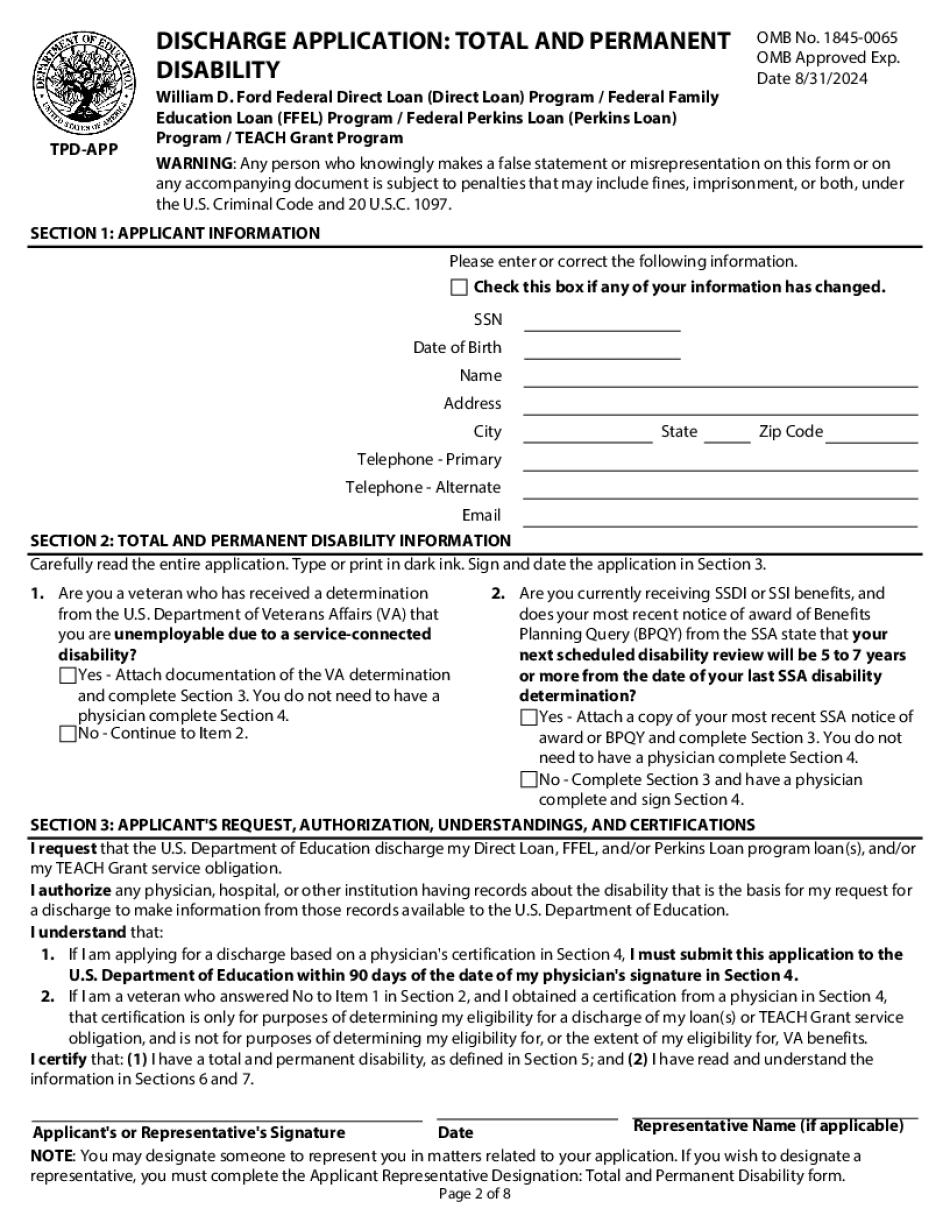

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Discharge Application, steer clear of blunders along with furnish it in a timely manner:

How to complete any Discharge Application online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Discharge Application by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Discharge Application from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Private student loan forgiveness