Elizabeth Warren's townhall focused on her economic proposals, including her plan to alleviate student loan debt. - During the townhall, Warren shared her own story of finding opportunities to climb the economic ladder. - Warren mentions her experience with Community College and the affordability it provided for her education. - She talks about not having money in her family and not being able to afford a college application or four years of college. - Warren explains that she won a scholarship and later got married, leading her to drop out of school and work as a receptionist. - She then found a commuter college that only cost $50 per semester, allowing her to pursue a four-year diploma and become a special needs teacher. - Warren believes that these opportunities for education and upward mobility should be available to all Americans, not just the privileged. - She discusses her policy proposals, including a two-cent wealth tax to fund universal childcare, universal pre-k, and universal college education. - Warren emphasizes the need to address the burden of student loan debt while still having resources for other investments. - She argues that these policy proposals are essential in combating Donald Trump's presidency. - It is highlighted that Warren has released detailed policy proposals, distinguishing her from other candidates. - Her answers in the townhall were lengthy due to her extensive policy knowledge and plans. - The idea of waitressing as a pathway to progressiveness is mentioned, noting that many successful individuals started in service positions. - However, there is criticism towards some politicians who "burn down the bridge after they cross it," using Paul Ryan as an example.

Award-winning PDF software

What does pending final approval mean on student loan discharge Form: What You Should Know

Question of your eligibility for student loan discharge In many cases, it will be very difficult to get the student loan discharge and the student might have to sign the contract with a lawyer. As a result, some borrowers are unsure why their SSA information was not sent back to SSA in a timely manner; this is what they want to know. There are some loans that are not eligible for student loan discharge, which is why it is very important for you to contact the person/creditor responsible, so you can get a determination from your SSA. The SRS office will inform you about your eligibility for that type of loan. There are some exceptions to this rule. The “Special Education Loan Program” is one exception. This program does NOT affect SSA eligibility and is not processed via Telnet. You are still required to submit a paper form to the SRS (SSA Disability) office in order to make a determination. Question about student loan discharge When will I be notified of the student loan discharge I am eligible for? Your student loan will be mailed to you in 1 to 3 weeks after the student loan was approved. Please allow extra time in order to confirm all details prior to checking the mailing date. Question about student loan discharge Will I be paid any student loan debt at all if I am granted for student loan discharge? YES! The person that made the decision to approve your student loan discharge also decided to make a discretionary payment to you to help pay back your loan. Question about loan discharge The SSA is mailing you my loan information. Why won't it let me know if it has processed my student loan discharge? Why isn't “TELNET” working for me? Your loan holder will send the application for the loan to SSA in order to conduct the discharges. Some loan may not be processed by SSA due to limitations in their resources. Sometimes it takes up to 45 days from the time the loan was submitted until SSA will process the application. Once you have made a decision on the discharge package, you may get a letter notifying you of the decision via E-mail. This is a courtesy notification to let you know that your package has been mailed to SSA. Question about loan discharge I am very concerned about my student loan discharge application. My SSA office says my application has been sent to the SRS in a timely manner.

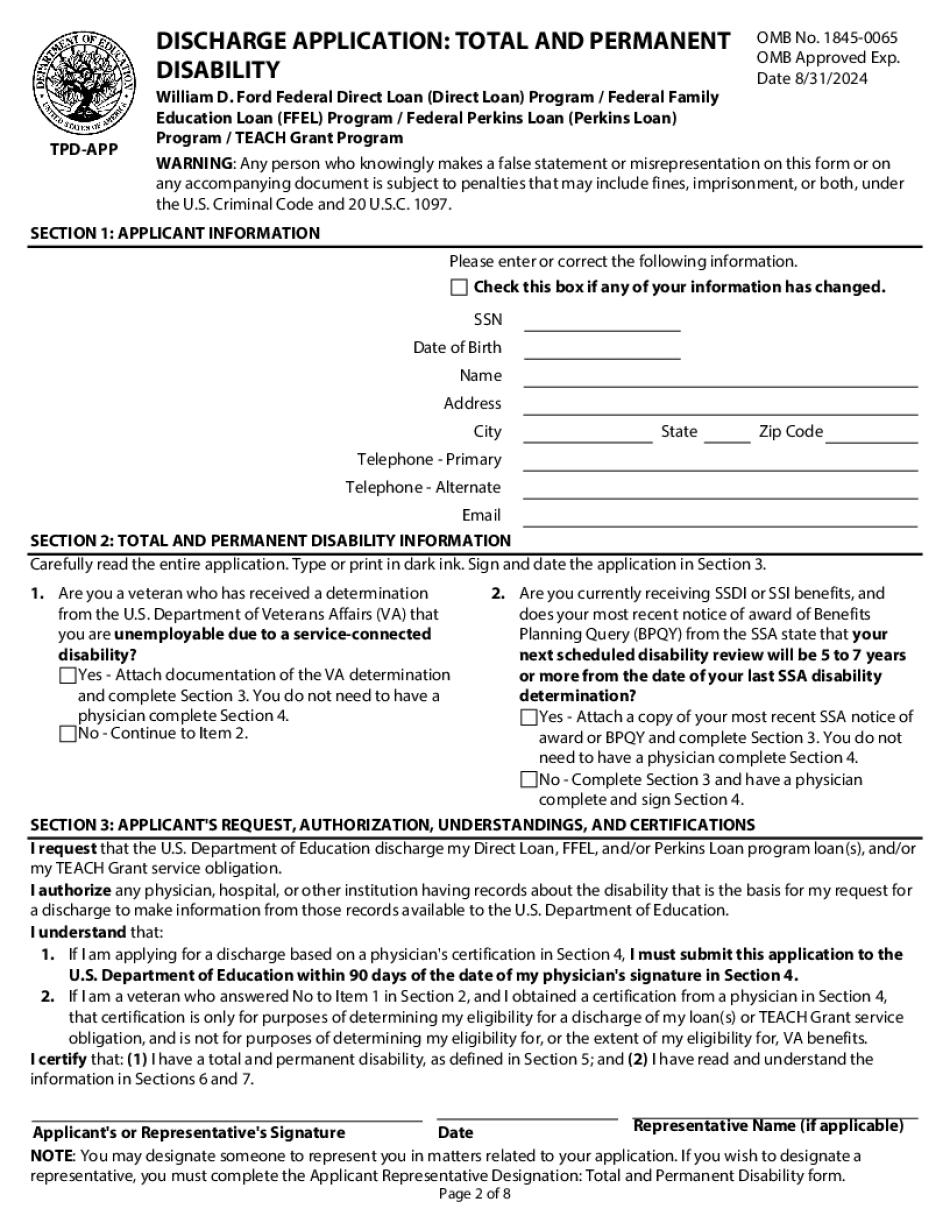

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Discharge Application, steer clear of blunders along with furnish it in a timely manner:

How to complete any Discharge Application online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Discharge Application by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Discharge Application from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What does pending final approval mean on student loan discharge