Hi, my name is Brooke Kramer and I'm the financial aid officer at Argosy University in Salt Lake City. Today, I'm going to let you know who qualifies for financial aid forgiveness, usually student loan forgiveness. The way you can determine whether or not you're going to qualify is to go to the Department of Education website to see if you qualify. Most people who do qualify are either working for the federal government or are also teachers. Many teachers qualify for a loan forgiveness program, but there are many stipulations to these forgiveness programs. So, you want to definitely find out what qualifications you need and also what stipulations are included before you qualify for those loan forgiveness programs. One time students wouldn't qualify for loan forgiveness is if there is, say, an accident or if you become disabled. Or even if you don't like the education you were given, during all of these circumstances, you are still obligated to repay your loans. So, it's very important that before you even stop making payments on your loans, you talk to your lender to find out what qualifies you for loan forgiveness or even loan deferment if such incidents have happened. If you have any other questions, please feel free to check out our website at WWDC.edu.

Award-winning PDF software

Department of education student loan forgiveness Form: What You Should Know

The qualifying organization must provide at least one part-time job for at least 2.5 hours per week, and work in a qualifying region of the United States for at least 70.5 percent of the time during the period of the loan forgiveness. I have submitted documentation from the Department to prove that I qualify. 5. If your Direct Loan is a PLUS Loan, the Education Department will continue to make loans to you without your consent until all of your other loans are repaid, and I have completed all the required steps on this form. I understand that I must complete the PSL Form to have my federal student loans eligible for debt relief and that I must provide proof to the U.S. Department of Education that I meet the eligibility requirements to remain eligible for PSL. I understand that I have to provide proof of my income and that I will be required to complete the PSL in order to remain eligible, so that the federal government has access to the records from my tax returns. I understand that the Education Department will continue to charge me interest on the amount of my loans forgiven after the PSL Form has been submitted in order to continue making payments on my federal student loans. I understand that your loan payments may continue to accrue interest. Furthermore, I understand the Education Department will still make payments on any remaining loans you have after the PSL Form has been filed. Furthermore, I understand that once PSL is submitted, my loans from the Education Department may no longer be in my name. Furthermore, I understand I may still be able to get a loan from a different lender, but I will be required to start all over again if I become financially independent. I understand that my loan balance may continue to accrue interest and I understand that the Education Department will continue to charge me interest on the amount of my loans forgiven after the PSL Form has been filed until the loan is repaid in full. I agree that I have accepted and will abide by the terms of PSL and must comply with the requirements stated on the form in order to remain eligible. I understand that my loan balance will be forgiven for all the loans I have borrowed while working for a qualifying organization. If you would like me to print a copy for you, please select on the “Print” link on page 7 of the PSL.

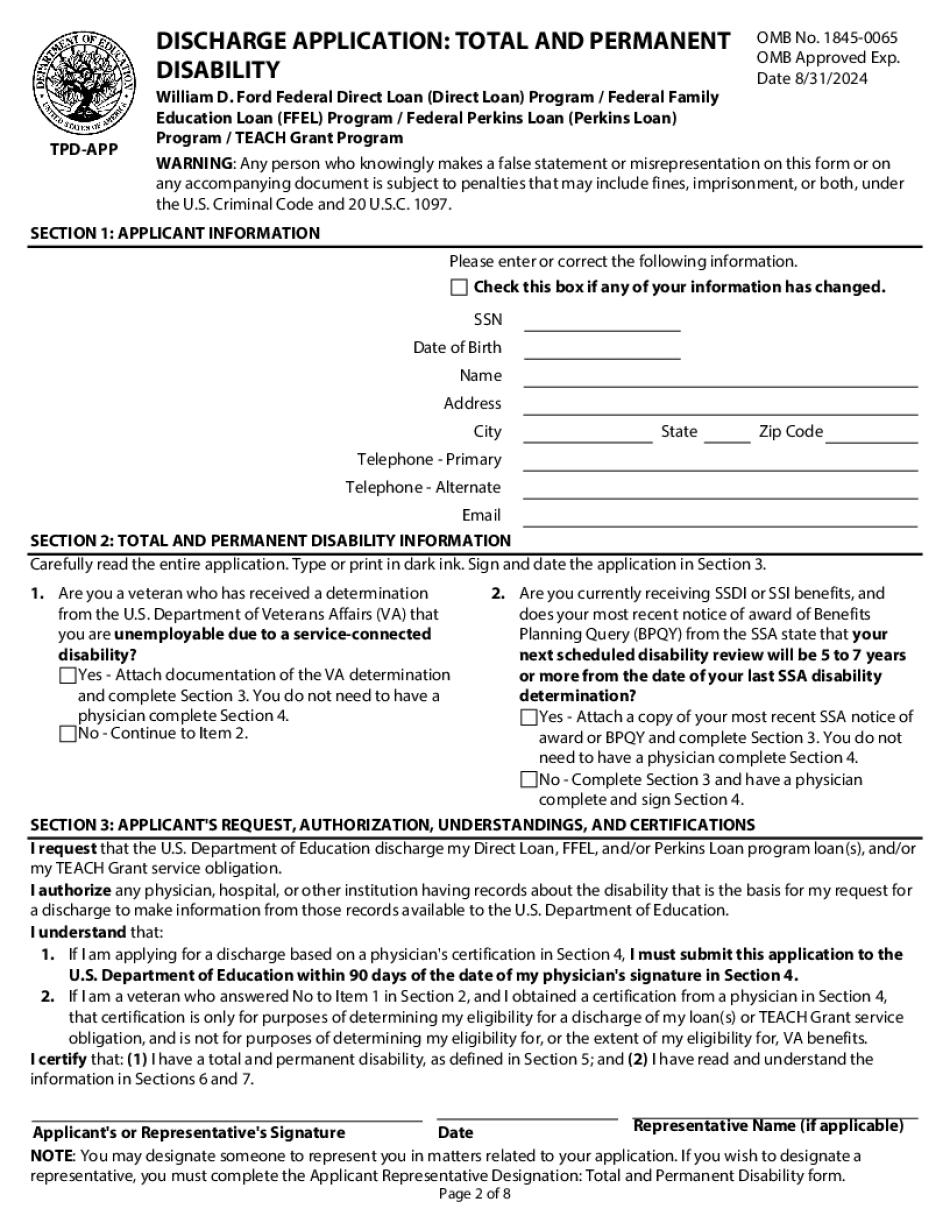

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Discharge Application, steer clear of blunders along with furnish it in a timely manner:

How to complete any Discharge Application online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Discharge Application by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Discharge Application from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Department of education student loan forgiveness