You'd like to figure out if student loans are forgiven due to death and disability. The answer is yes, but you need to double-check the new tax cuts in Jobs Act that President Trump and Congress signed in December 2017. These changes made some big changes in this area, with the main one being a scandal involving a veteran with a traumatic brain injury. This veteran had around $200,000 of loans forgiven due to his disability, but then received a bill from the IRS for $70,000. This is not a made-up scenario, folks. He called some representatives who took up his case and managed to change the provision in the tax code. Now, when someone's student loans are forgiven due to total and permanent disability discharge, the forgiving balance is no longer considered taxable income. Previously, if your loans were forgiven, you would receive a form known as a 1099-C, which indicated the forgiven amount as taxable income. However, in the case of death and disability, federal student loans should no longer incur taxes on the forgiven balance. It's important to note that the criteria for permanent disability are not easy to meet, and regular searches are conducted on the Social Security and VA rolls to identify individuals who meet these criteria. Despite the complexity, if you do become permanently disabled or pass away, you won't have to worry about making hefty monthly payments towards your student debt. The situation for private student loans is a bit more complicated. Many private lenders may claim to forgive your student debt in the event of death or disability, but this is discretionary and not contractual. In most cases, though, private lenders do forgive debts under these circumstances. However, it's worth considering protecting your family by obtaining life insurance. A term life insurance...

Award-winning PDF software

Disability Discharge Student Loans Taxable Form: What You Should Know

A Guide to Getting a Civil Suit Filed in the NJ Superior Court A detailed guide to getting a criminal complaint filed in the New Jersey Superior Court. The guide explains how to file and serve documents on criminal defendants. The Guide to the NJ Superior Courts The Office of the Superior Court will tell you the specific procedures each type of case needs to follow in order to get a complete, accurate summary of the case. Filing and Serving a Civil Action: Summary (NJ) A Practice Note explaining how to file and serve and summary of the case in the New Jersey Superior Court. How to File a Claim against a Company or a Business (NJ) A Guide to filing a claim and filing a claim against a business A Guide to Serving a Civil Claim in NJ (NJ) This is a comprehensive guide to serve and file a civil claim in NJ. It explains when and how to file and service an action with a civil complaint in the Superior Court. Summons and Attached Proof of Service (NJ) — What You Need to Know (PDF) Summons and Attached Proof of Service (PDF) is a concise guide outlining the procedure for issuing and serving a Summons and Attached Proof of Service document, including: Notice to defendant; Claim filed with clerk; Notice; Filing fee; Attach proof of service in document; Summons; Attached Proof of Service; Time limit on filing claim for small claims; Notice to defendant. Form 8: Filed Proof of Service The Court must be notified of an action for relief. This form provides a summary of the documents required to be filed with the clerk of the Superior Court that the clerk must accept and the time to file. Form 8: Attachment to an Order, Order to Show Cause, or Answer or Order to Show Cause (NJ) This form allows you to attach evidence to an order, order showing cause, or answer or order to show cause filed or served in court. Form 8 allows you to attach the evidence to any document. In the case of an answer or show cause, the court will determine whether it should be accepted by the clerk. Form 8 does not allow you to attach the evidence to a summons. Form 8 Form 8 — Attachment to an Order to Show Cause or Answer or Show Cause (PDF) This form is used to attach documents or evidence to a document containing an order, as a service of process or as an answer or show cause.

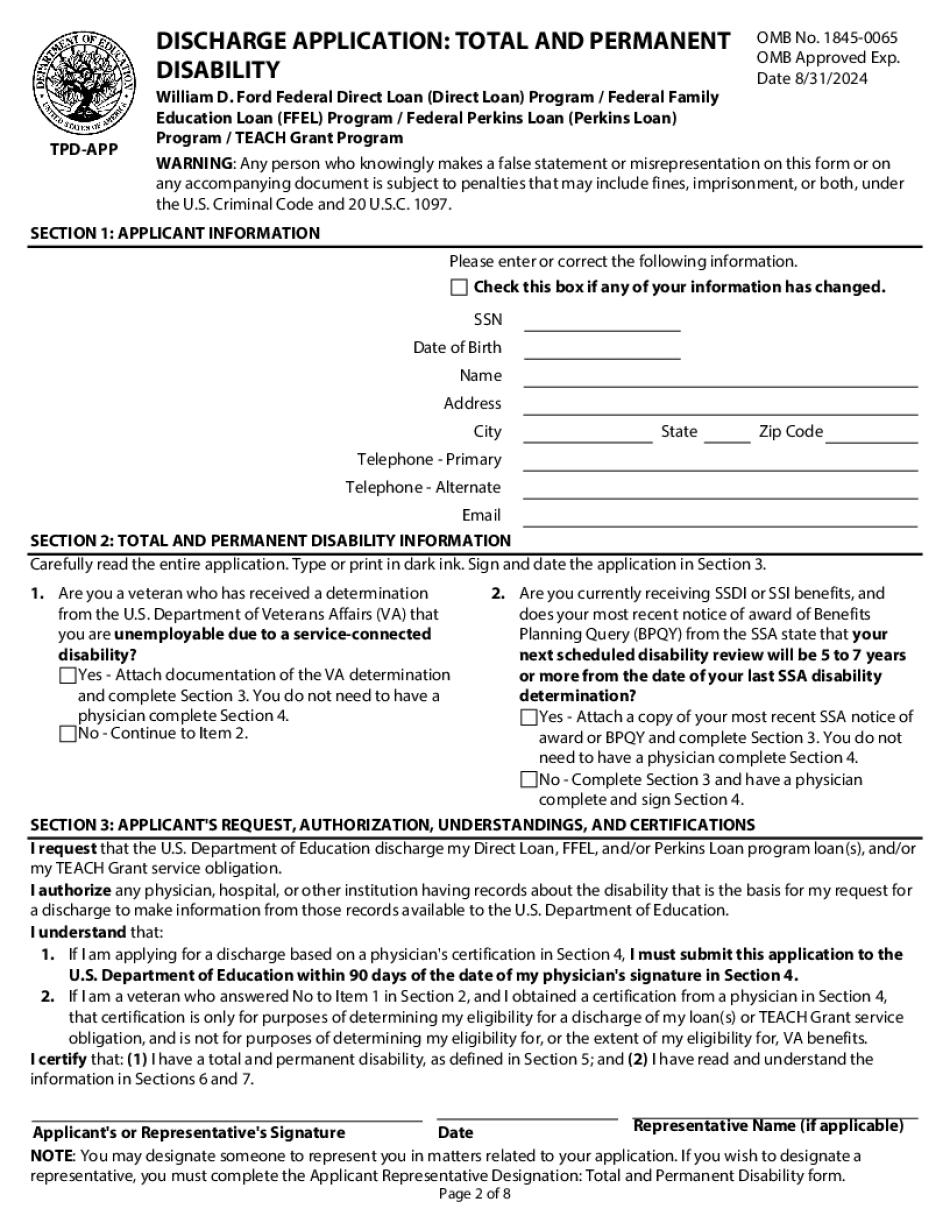

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Discharge Application, steer clear of blunders along with furnish it in a timely manner:

How to complete any Discharge Application online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Discharge Application by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Discharge Application from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Disability Discharge Student Loans Taxable