Hi again, this is attorney Robert Fleshes. Today, I'm going to talk about student loans and how they are treated in bankruptcy. One must meet a threshold in order to receive a discharge of this type of debt. But first, if you find my videos informative, please consider subscribing to my channel. Student loans have become a huge problem in our country. U.S. student loan debt reached approximately 1.5 trillion dollars in 2018. That is staggering. Student loans represent debt that is generally not dischargeable in bankruptcy. The federal government funds student loans and expects students to repay them, except in rare circumstances where an undue hardship exists. Congress excluded student loan debt from discharge, unless the debt will impose an undue hardship on the person who incurred it and their dependents. Undue hardship is defined as excessive or unwarranted, and more than the usual hardship. Simply being unable to pay a student loan debt doesn't qualify. Could you imagine what would happen to our economy if all student loan debt was automatically dischargeable? It would be a disaster. In order to prove undue hardship, a debtor must establish three elements: 1. The debtor can't maintain a minimal standard of living for themselves and their dependents if forced to repay the student loans. 2. Circumstances exist showing that this minimal standard of living will continue during most of the repayment period. 3. The debtor made a good faith effort to repay the student loan. If the debtor can't establish all three elements, then their debt won't be discharged by the court. So, it's almost impossible to discharge student loans in bankruptcy. Even arguing negative tax consequences from an income contingent loan repayment plan won't convince a court to discharge a student loan. Historically, student loans were dischargeable before 1978. However, tuition costs in those days were nowhere close...

Award-winning PDF software

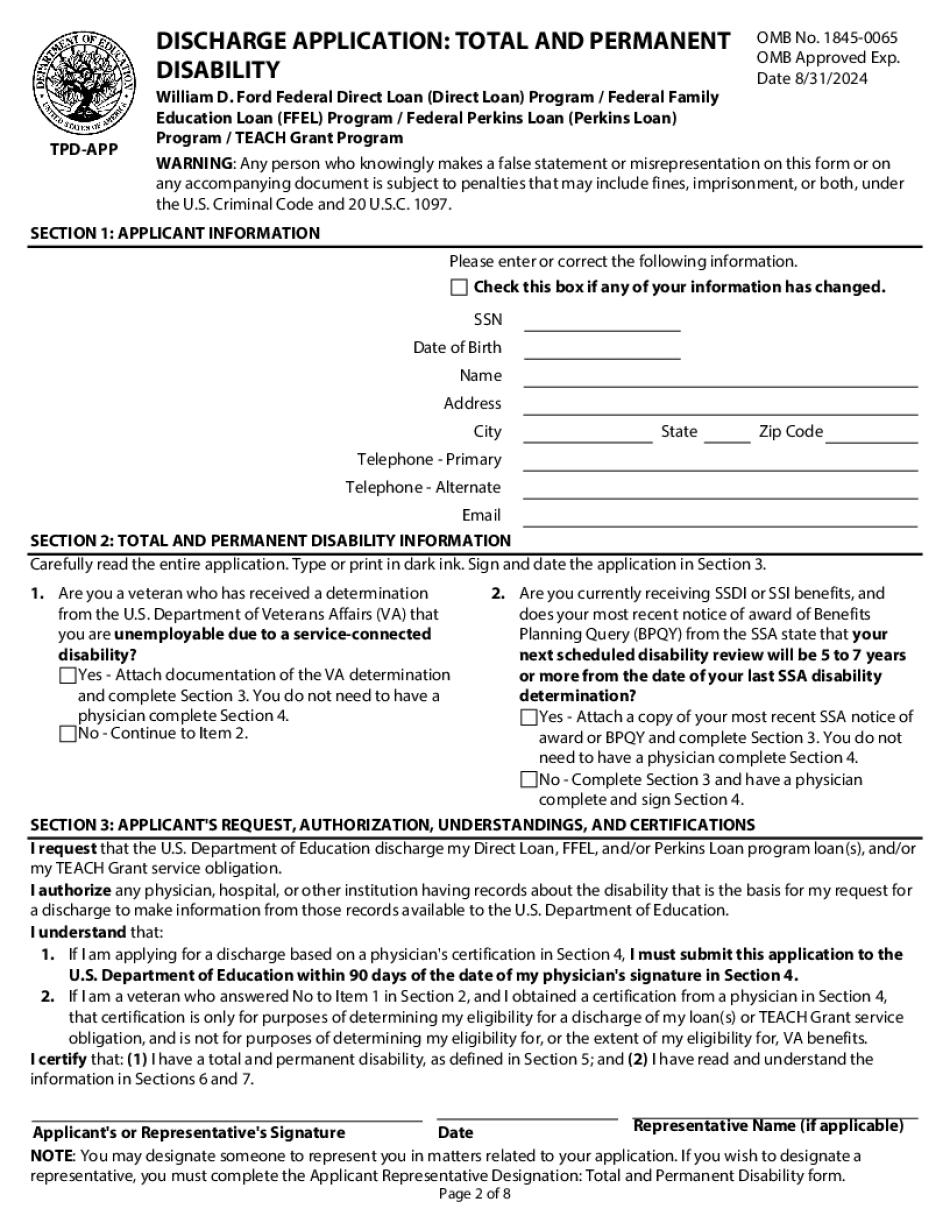

How long does a tpd discharge take Form: What You Should Know

Therefore, there will be no longer be a waiting period to review and submit a TED discharge application if you meet all the following conditions: Automatic TED Discharge Based on VA Data Match — Do Not Assign Loan,” schools must assign loans to the Department within 45 Automatic TED Discharge Based on VA Data Match — Do Not Assign Loan,” schools must assign loans to the Department within 45 Dec 31, 2025 — Total and Permanent Disability Discharge. How does a school get paid for the loans it assigned to the Department of Education? The Department of Education's (DOE) Direct Loan program pays for the loans permanently assigned to the Department of Education, regardless of whether the school retains the loans on its own, through transfer to third party collectors, through a collection agency, or through bankruptcy. The only way to avoid having to make payments to the Department of Education is to have your educational loans transferred to an indebted third party collector. If you are unsure who the third party collector it should you not know within 30 days of your application date, you are advised to contact the Consumer Financial Protection Bureau. How do I submit my information? All documents should be submitted as PDF's. To learn more about the new process and the information you need to provide when filing an application, read the following two documents: The form to Complete Your Disability Discharge Application (PDF). The form to Submit Your Application and Documentation for Your Disability Discharge (PDF). What type of information should be gathered regarding my pre-discharge loans? When you apply for a disability discharge, the Disability Determinations Center (DDC) will evaluate your prerelease loans against the criteria below. To obtain a determination, complete the Disability Discharge Application (PDF) and submit it to the Disability Determinations Center. After the Disability DDC has completed its review, the Disability Discharge application will have been received by the DOE and the Department will be notified of your application status. Your prerelease loans (included on Appendix A and/or Appendix B) are reviewed at the time the Disability Determination Center submits you for a processing decision.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Discharge Application, steer clear of blunders along with furnish it in a timely manner:

How to complete any Discharge Application online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Discharge Application by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Discharge Application from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How long does a tpd discharge take