Welcome to my first video. I'm going to be talking to you a little bit about student loans and the disability discharge process. I recently went through it and actually had my loans cancelled due to my disability. I have a mental illness which qualified me for the discharge. The first thing I'd like to tell you is that it's a great idea to consolidate your student loans. You can get one loan with one interest rate, which is a lot easier to manage as far as payments are concerned. You just have to call your loan holder and ask for consolidation. Loan elimination will most likely give you one loan. The information I'm talking about can be found on the website disabilitydischarge.com. That's how you can find out a lot more about the process. This process is for federal loans, also known as direct loans. My loan holder was Direct Loans. In order to qualify, you need to be totally and permanently disabled. You have to get paperwork from your doctor that says you are totally and permanently disabled. If you're on Social Security disability, you can get the necessary paperwork through them, but you have to be on a certain type of Social Security. For veterans, there's another process, but I don't know the details. If you're approved for the discharge, there are certain conditions you have to meet. It is a difficult and long process. After approval, there is a three-year post-discharge monitoring period. They monitor the amount of money you make and don't allow you to go over a certain income limit. In my state, that was about $15,000 a year. They only count income from employment, not Social Security disability income. During these three years, you have to watch how much money you make from employment, and you cannot take...

Award-winning PDF software

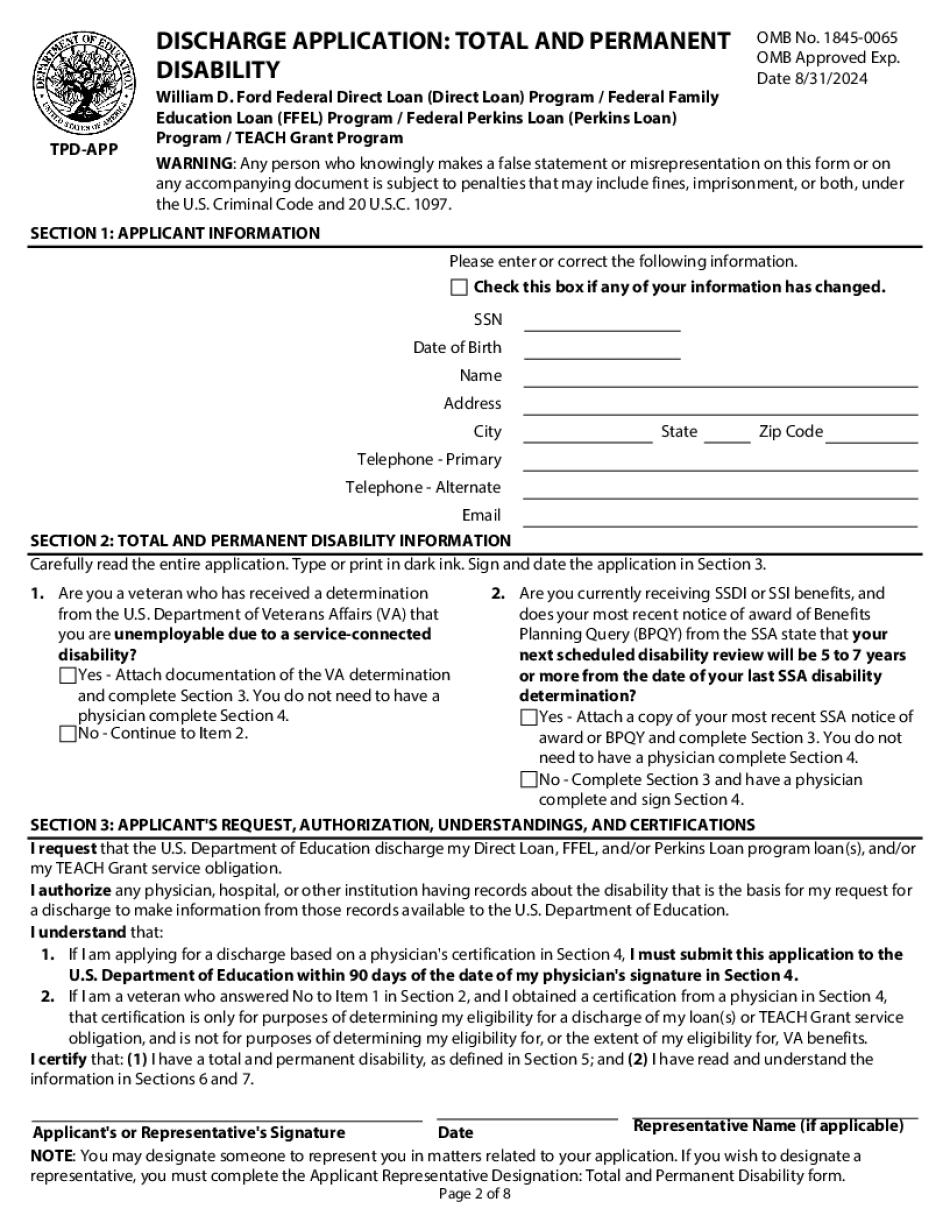

Tpd discharge taxes Form: What You Should Know

This discharge would occur if: (1) Your Adjusted Gross Income (AGI) exceeds certain limits, (2) You fail to repay on time due to a financial commitment to certain family members, or (3) You have a disability and cannot work. To help if you have made a voluntary financial commitment to the same family members, refer to our disclosure letter for a list of family members who may be responsible Next steps in applying for the total and permanent disability discharge for federal student loans: Complete and sign the application for a total and permanent disability for federal student loans. Complete and sign the form for a total and permanent disability for certain federal student loans in lieu of the Form-1213 and Form-240. Submit the application for the total and permanent disability for federal student loans by mail : You are responsible for mailing the application to us. If you have already filed your application, you don't need to file an updated application since your information and your signature are already completed. If you don't have a fax service, please contact us for a copy. Complete and sign the form for a total and permanent disability for federal student loans (Form-240) in lieu of the Form-1213 and Form-240. If you have already filed an application for the disability discharge, follow the instructions to submit your updated Form-240. You must submit a copy by certified mail. If you do not have a fax service and need a certified copy of the Form-240 (Form-240C does not do this), please contact us with your information. Mail the application for a total and permanent disability for federal student loans and any supporting documents in the return filing envelope that you received in the Federal Student Aid Checkbox in your application(s). If you do not complete all necessary steps and have made a voluntary financial commitment to the same family members, submit the application as a copy of your application for an FEEL Program loan (Form-1059) instead of the Form-240.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Discharge Application, steer clear of blunders along with furnish it in a timely manner:

How to complete any Discharge Application online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Discharge Application by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Discharge Application from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Tpd discharge taxes