Welcome to part 2 in our series on federal student loans. If you were here in part one, you were here when we covered three of the more commonly known repayment plans that are based on what you make rather than what you owe. So, we covered the revised pay as you earn, the pay as you earn, and the income-based repayment plan. All three of those plans ask you to pay a percentage of your discretionary income each month. So today, we're going to cover what that discretionary income is and how it is used by your loan servicer to determine what you pay each month towards your loan. Let's get started. Before we get to the calculation to determine your discretionary income, we have to introduce the term federal poverty line. Every year, the Department of Health and Human Services releases a federal poverty line. Based on the number of people in your household, they are going to say, "At this salary or below, if that is your income, you are considered impoverished." For example, in the mainland states (the 48 mainland states) in 2017, the federal poverty line for a one-person household is $12,060. As you add more people to your household, that federal poverty line increases. So, if you want to see what it is for your situation or if you live in Hawaii or Alaska, you can actually follow the link at the end of this video, and it will take you to that page so you can find the federal poverty line for your household. Now that you know that term, we can tell you the calculation for discretionary income, and that is your salary minus one and a half times the federal poverty line for the number of people in your household. Let's look at...

Award-winning PDF software

Student loan repayment calculator Form: What You Should Know

Undergraduate Student Loan Calculator — Federal Direct Student Loan Payments If you're still unsure about how IBR affects how much you can repay in a given period of time, you can use this tool to see if you could be eligible for a lower monthly payment. Get Your Free Loan Quicken Account & Start Saving Today Federal Pay As You Earn Student Loan Calculator If you're a current federal student, it's time to look at how mypayasoweereveryone.com can help you pay off student loans at affordable rates. Federal Student Loan Payment Calculator The best way to figure out if you could be eligible for a lower payment plan depends on the interest rates and monthly payments you're looking at for each type of loan. Federal Direct Student Loan Payment Calculator You can use this calculator to determine what type of student loan you might qualify for, how long it will take you to pay off your loans, and what your monthly payments will be. Student Loan Payment Calculator If you can't find the information you're looking for, contact mypayasoweereveryone.com, and we'll help you find everything you need to know about your student loan payments.

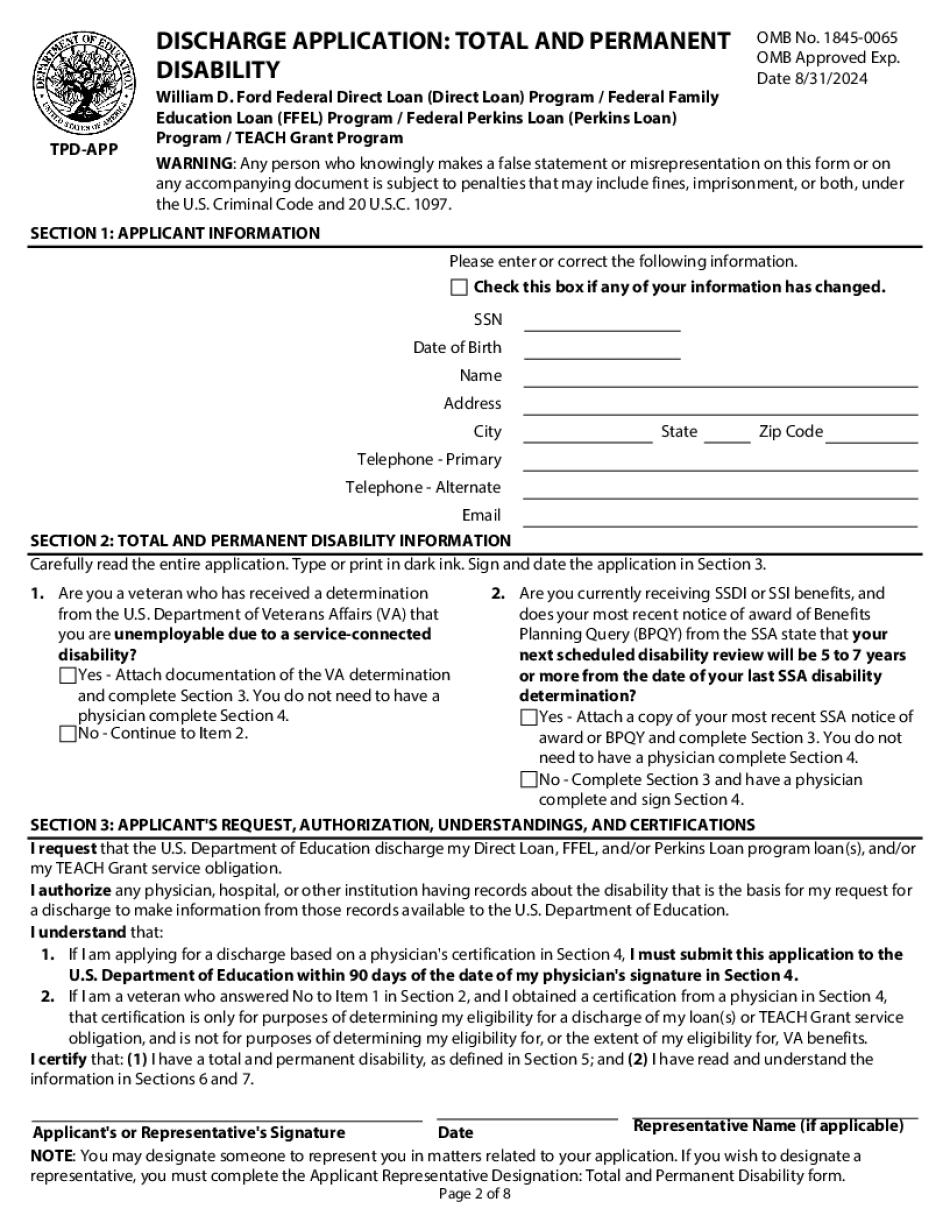

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Discharge Application, steer clear of blunders along with furnish it in a timely manner:

How to complete any Discharge Application online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Discharge Application by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Discharge Application from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Student loan repayment calculator